Products

ACCOUNTIV™ Financial Management

Financial Management

General Ledger, Accounts Receivables, Accounts Payable, Sales Ledger, Cash Application, Credit Management, and Purchase Ledger

GENERAL LEDGER CONTROLS

The general ledger module provides control and analysis of the financial status of the company and all its reporting entities. General ledger information is automatically received from other Xperia modules.

CREATION OF GENERAL LEDGER

RELATED DATA BASES

-

Twenty position general ledger account number

-

Up to 13 accounting periods

-

On-line general ledger master file maintenance

GENERAL LEDGER PROCESSING

-

On-line batch journal entry and update

-

Reoccurring entry processing

-

Revision capability against original or current budget

-

Variance reporting against current budget and last year actual

-

Ability to copy general ledger masters from year to year with balance forward capability

-

Ability to copy general ledger masters from division to division

-

Automatic allocation by period of annual budget

-

Ability to copy repetitive journal entries from period to period

-

Automatic generation of reversing entries at the beginning of new accounting period

CONTROL AND STATISTICS

-

Authorized user control of G/L information

-

Trial balance inquiry and report by period/year or G/L number in detail or summary

-

Period reports (P&L and balance sheet) by division or consolidated in detail or summary

-

P&L reporting by department or cost center

-

Tailored reports based upon user-defined parameters

-

Complete audit trail on all G/L transactions

-

Complete flexibility in the determination of accounting periods

ACCOUNTS RECEIVABLE/SALES LEDGER MODULE

The A/R module enables your business to effectively manage accounts receivable assets; collect and apply cash more readily and efficiently; and minimize bad debt loss. Accounts can be handled on either an open item or balance-forward basis. Invoicing and credit memo information is automatically received from the Order Entry and Control module.

CASH APPLICATION

-

Cash application by specific item, range of items, cash-in advance, unapplied cash, or multiple adjustments with comments

-

Control of checks at batch and detail check level

-

Complete audit trail of processing

-

On-line customer identification via MICR number, invoice number, or name

-

Customer identification immediately reduces A/R balance without the need for application of cash to specific open items

-

On-line cash application from multiple display stations

-

Ability to completely reverse cash application regardless of the date upon which the cash was originally applied

-

Lock box processing

-

Immediate updating of A/R data files

-

Cash receipts journal with general ledger updating

CREDIT MANAGEMENT

-

On-line review of customer open and paid items

-

On-line customer aging

-

Automatic generation of past due items for credit management review

-

Customer statements with aging and broadcast messages

-

Automatic dunning letters

-

Automatic credit checking based on organization parameters

-

Automatic scratch pad memo for credit follow-up by multiple users

-

On-line credit release by credit manager, division, order, or order line

-

Late payment calculations

-

Automatic input from credit agencies

-

On-line history of customer payment trends

MANAGEMENT OF UNAUTHORIZED DEDUCTIONS

-

Claims follow-up processing with G/L interface

-

Scratch pad memo for claims actions

-

Automatic identification of disputed items

-

Assignment of claims numbers with associated comments

-

Automatic generation of claim's letters identifying items in dispute

-

Batch entry function for input of factor charge backs

ACCOUNTS PAYABLE/ PURCHASE LEDGER

The Accounts Payable module controls open accounts payable and cash disbursements on either an accrual or cash basis.

CREATION OF VENDOR RELATED DATA BASES

-

Up to five default general ledger distribution numbers attached to each vendor

-

Pay-to-number assignment for each vendor number

-

Vendor terms with automatic due date calculation

-

Vendor representative, telephone number, and fax number

-

On-line vendor maintenance, inquiry, and statistics

-

On-line maintenance of master files allows for change or addition of invoices, credits, manual checks, and check reversals

-

1099 tracking

PAYMENT PROCESSING

-

Calculation of vendor discounts and anticipation

-

Inquiry of open and/or paid items by vendor

-

On-line automatic or manual selection for payment by vendor or due date

-

Reoccurring entry processing

-

Due item reporting by due date within vendor or vendor within due date

-

A single invoice can be distributed to multiple general ledger accounts

-

Partial payments can be made against individual invoices

-

On-line review of G/L account numbers from A/P

-

Invoice processing in various currencies while maintaining balance information in a base currency

-

Ability to make currency valuations at invoice time, payment time, and period end with automatic general ledger entry of variances based on current exchange rates

-

Ability to associate invoice detail to specific checks

-

On-line preliminary check register capability

-

On-line check printing capabilities

-

On-line check register

-

Advance payment capability

CONTROL STATISTICS

-

Check reconciliation by number and dollar amount

-

Multiple banks with detailed statistics

-

Period reports and audits

-

Three-way match invoice with purchase order and receipt

-

Complete audit trail

CREATION OF PAYROLL DATA BASE

-

Operation routings for manufactured items

-

Grouping of operations into subassemblies

-

Creation of item routings

TRACKING OF INCENTIVE PAY

(SOURCE TO GROSS)

-

Printing of bundle tickets

-

Bar code scanning of tickets for completed operations

-

Operation master allows piecework incentive rates to be expressed in SAMS as well as dollars

-

Immediate editing and updating of bundle coupons

-

Plant, work center, section, and operator efficiencies

-

Out-of-sequence operation warning

-

Split coupon/bundle control

-

Straggler bundle control

-

Work order incentive coupons for short cycle operations

-

Calculation of pay for modular team production

-

Calculation of daily earnings

-

Improve visibility into financial processes and overall performance

-

Reduce errors, cycle time and processing costs

-

Achieve data consistency and accuracy

-

Enforce global financial standards and processes

-

Implement adaptable financial business processes on a global scale

-

Improve user productivity through easy reporting, querying, and data entry

-

Comply with Sarbanes-Oxley reporting requirements

-

Enable collaboration inside and outside the organization

Financial Management

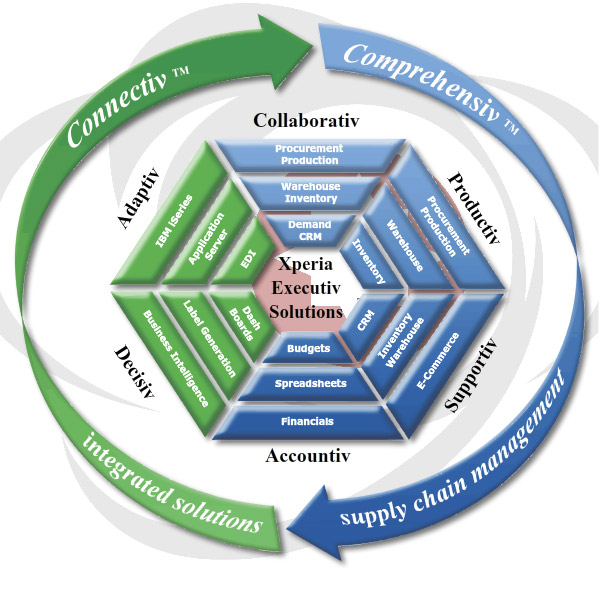

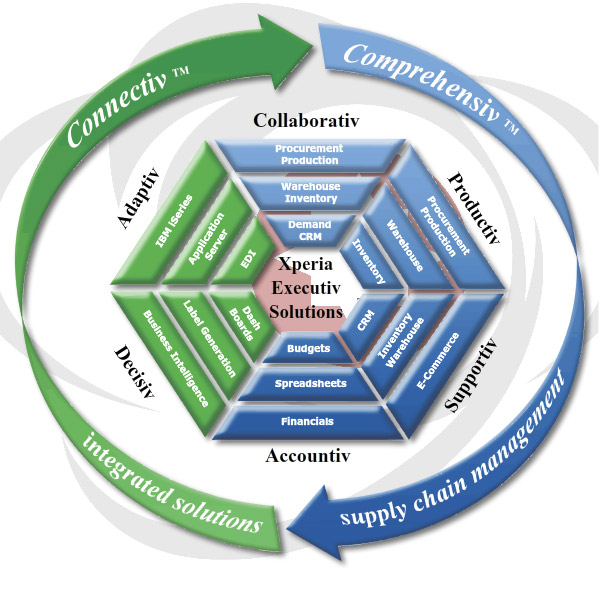

Xperia Financial Management Applications provide a comprehensive suite of applications that range from accounts receivable, accounts payable, letter of credit, to general ledger. All aspects of our total solutions integrate to the general ledger allowing the user to greatly reduce journal entries.

The general ledger module provides control and analysis of the financial status of the company and all its reporting entities. General ledger information is automatically received from other Xperia modules.

The A/R module enables your business to effectively manage accounts receivable assets; collect and apply cash more readily and efficiently; and minimize bad debt loss. Accounts can be handled on either an open item or balance-forward basis. Invoicing and credit memo information is automatically received from the Order Entry and Control module. Accounts receivable provides an auto cash option. The auto assigning of open items to customer checks as well as a real-time view of outstanding balances, scratch pad follow-up, and credit evaluation are also key elements in this segment of the application.

The letter of credit module is integrated to the production procurement application as well as the accounts payable module, and this system automatically tracks the purchase order and letter of credit relationship. The accounts payable module is integrated to the product procurement application whether you purchase raw materials, office supplies, or finished products. All modules provide seamless interfaces to the general ledger. Budgeting, profit and loss, and income statements are also included.